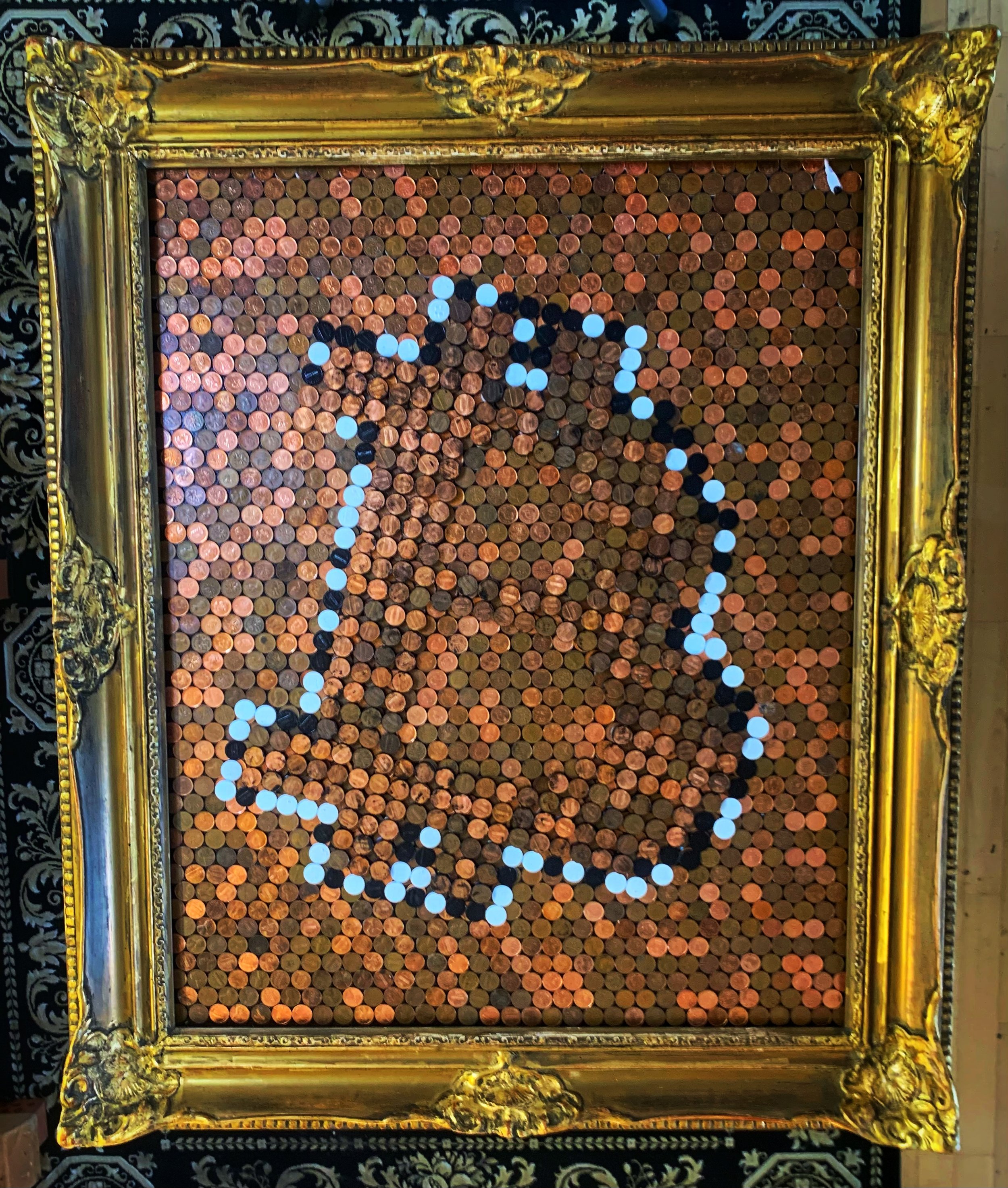

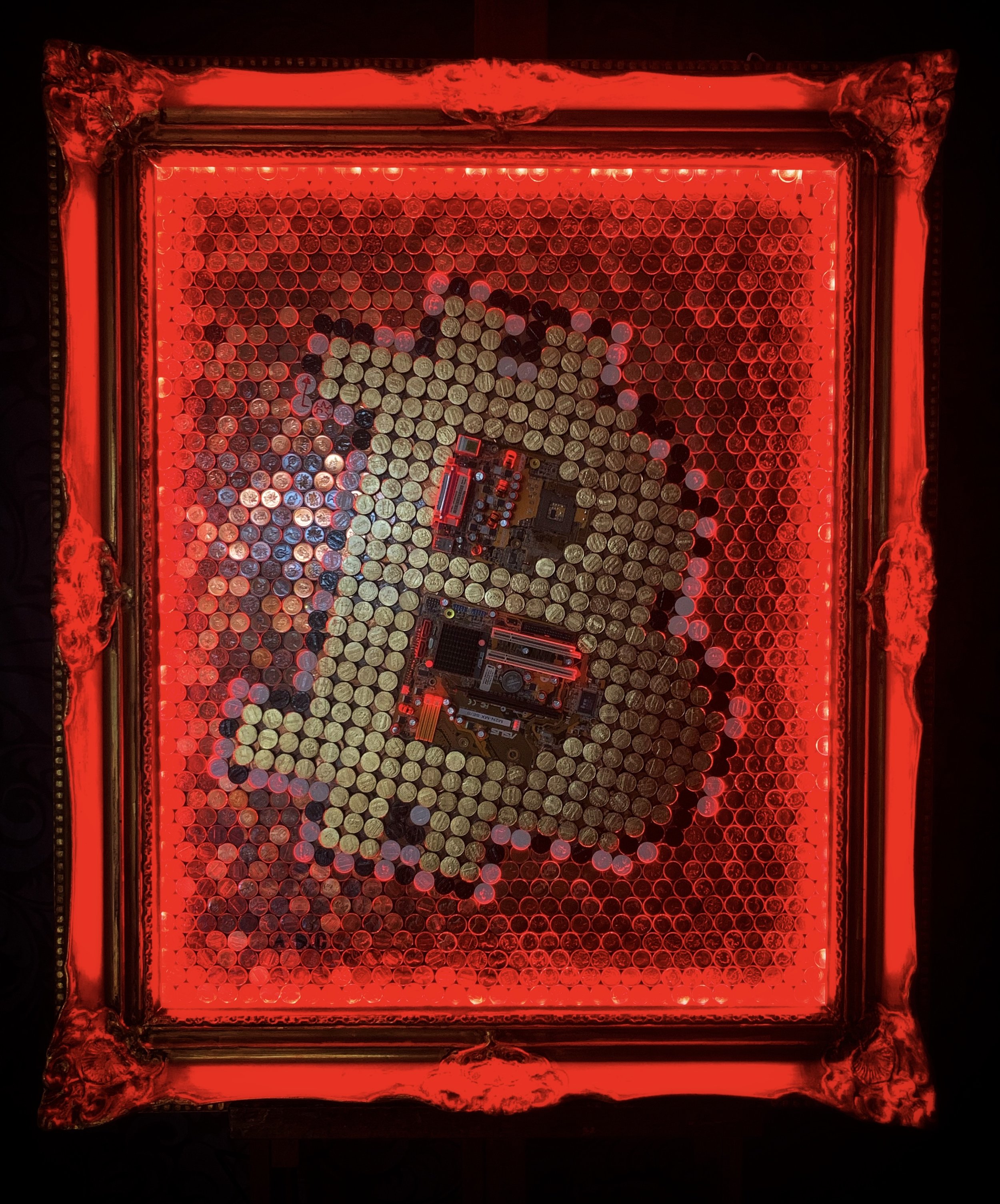

A07 - 🪙 Coin ≠ Coin 🪙

Status Art Work: finished ✅

Artwork is for SALE

Price: on request (only payable in Bitcoin)

Art Work has 1 Secret Message 🤔 (Level Easy ⭐️)

Height: 96.5cm x Wide: 81cm x Depth: 9cm x Weight: 18.8kg

💯% PoW, 💯% handcrafted, 💯% Swiss made 🇨🇭

From High End Bitcoin Art to Wearable Art & Merchandise

Copyright © : This artwork is one-of-a-kind, authentic, original artwork. The artist reserves to himself all copyrights of the original art. Reproductions may not be made without permission.

CoA: The artwork comes with a purchasing contract, a handwritten certificate of authenticity on original Egyptian papyrus paper, signed by the artist & with his wax seal.

Art Work Trailer:

-

Look closely. What do we all have in common?

No matter what corner of the world you live in you need food, water, shelter & money. Half of every transaction involves money in exchange for goods or services. Stocks, a loaf of bread, gasoline, illegal drugs, you gotta pay for it.

We spend much of our lives chasing money to make a living & accomplish our dreams. But it's also an instrument of destruction, some might say evil, driving some peoples to lie, steal & even murder. Money is a catalyst for the worst & the best of human endeavor.

Before civilization, we created currency, fuel for wars, the path to power, champion & enemy of innovation. Money is so integral to our society & our global economy, that it's true nature remains a mystery to most.

No matter how fat your bank account or how thin your wallet, to us all it's all cold hard cash. There are some who want to kill it, get rid of it, burn your Dollars, your Euros, your Yen & transform every penny you have into ones & zeros, digital currency, entrusted to the web & computers spread across the planet, magic internet money. It's called cryptocurrency, Bitcoin, invented in secret, it was a gift to the world. A potential curse for the banking system, breaking every government's grip on money supply.

Is Bitcoin the currency of the future? A godsend for criminals? Or a recipe for financial disaster? If you trust your money just as it is, be careful not to be tricked…

Once upon a time there was a big party, with everyone standing around the punch bowl, drunk! Politicians credited the strong economy to their wise decisions. Businesses jumped into new profitable markets, ignoring risk. In fact, the experts said there was no risk.

Then, troubling market data from minor countries spooked the markets. Rumors spread. More bad news rattled housing prices at the heart of the financial world. A major bank went insolvent. Investors & businesses made a run on the other banks, demanding their cash deposits. The largest financial institutions in the center of the modern world were frozen. Assets were seized. Banks foreclosed. A credit crunch threatened the entire world economy. & then, finally, the government stepped in. The largest bank bailout ever. Swift action by the head of state had saved the day. Remember that? No, you don't. It happened 2,000 years ago.

Rome, 33 AD, ground zero for the first recorded liquidity crisis & government bailout in history. The largest empire the world had ever seen was brought to it's knees by a banking disaster. Emperor Tiberius used money from the National Treasury to bail out the country's troubled banks & companies. History may not repeat itself, but it certainly rhymes, badly. People in power & their money have always been at the very center of it.

The story of money is as old as civilization itself. When we lived in small tribes, keeping track of debt was easy. You owed somebody a load of firewood, a neighbour owed you a piece of meat. Credits & debits were kept in your head, a mental ledger. Currency is a language that allows us to express transactional value between people. It's a technology that's older than the wheel. It's as old as fire. When humans wanted to trade outside their tribe or village, they needed something everyone could agree had value. Something scalable. Enter commodity monies.

There were many kinds but each had to embody the same five characteristics. A commodity money is relatively scarce, easily recognizable, can be cut into smaller pieces, you can substitute one piece for another of equal value & you can carry it around without too much trouble. In ancient Rome it was salt, the Aztecs used cacao beans, it was whale teeth on Fiji, Yak dung in Tibet, shells in Africa & China. Grains, metal, ivory, rare stones, leather, fish… If it had the five characteristics of commodity money, someone probably used it as currency.

You may ask: What value do these currencies have? If you go to a prison, you will see inmates use coffee, soups, cigarettes, drugs as currency. If you go into kindergarten or a primary school, you'll see children exchanging rubber bands, pokemon cards, baseball cards, sweets & candy & any other form of currency. People invent currency when they have no other currency & now we have invented digital currencies. Throughout human history, we have being dependent on a medium of exchange & a store of value to survive.

But commodities that aren't durable, are a lousy store of value. A bad cacao crop or a huge new salt discovery can throw your currency & economy into turmoil. A more stable system was needed. About 2’500 years ago the first metal coins were minted in China & in what is now Turkey. These coins shared the same five characteristics with commodity money, but were also very durable. In some cases, coins are the only thing left of entire civilizations.

Money does not originate with goverments. Money arises naturally as markets began to develop & as people with the advision of labor, realized that if I have eggs & you have a cow, we may need some medium of exchange, in order for you to buy my eggs & for me to buy your cow.

Coins were an objective & universal unit of account & they allowed people to buy & sell goods over vast regions. The market economy was born. Coins worked. But only if people trusted that the king or emperor who issued them wasn't cheating on the metal content. Using coins also meant that an authority now controlled the supply of your currency. Money & political power were inextricably linked, centralized. Minting coins in a steady & predictable manner, allowed economic growth & stability. The Wu Zhu coin in China retained it's value for 500 years. In Constantinople the Solidus lasted for 700 years.

But in those times the coins didn't have the milled edge, they were flat. & what used to happen was as coins were passing from people to people, people would cut little bits off. & in fact some of the taxation that the Kings would do, they would actually be taking 1/8 of the coin off. Taxes built castles & financed military campaigns, expensive hobbies. Soon royal mints were substituting cheaper metals for silver & gold. This is called "debasement" & Europe's Kings, made a habit of it. The currency of France was debased every 20 months for 200 years! If no one can trust the gold or silver content of your coins, how can you trade with other countries?

International merchants found a solution. They recognized that one person's debt has value, it can be traded or transferred. When those IOUs came from reputable sources, they could be used as a form of money, paper money. This money was not based on hard commodities or metal, but instead on someone's promise to pay. Merchants families like the Medici in 15th century Florence acted as clearing houses for these IOUs.

It worked like this: An English trader ordered a shipment of Italian cloth from the Medici for 100 gold coins. His promise to pay the Medici was put on paper. Meanwhile, the Medici owed 100 gold coins to another trading partner for delivery of wine from France. The parties didn't go to the expense of transporting & exchanging gold coins. Instead, the paper was transferred. Everyone agreed that the paper had value: "100 gold coins”. But only because everyone trusted the Medici as solvent middlemen. They had created a paper money machine. Within a few generations, they rose from low crime to high finance. Their great wealth helped fuel the Italian Renaissance & elevated the family to levels of enormous political power. The power to marry into royal families & get elected as popes. The ties binding money to power, politics & influence now ran through church & state.

Merchants had proven that creating paper currency could be wildly profitable. Goldsmiths wanted in on the action. Imagine it like this: If the goldsmith had seen over a period of time that some of the coins he was storing for people, were gathering dust, the people who owned them, don't need them right now. So the goldsmith said: what if I go & lend them out into the community & I charge them interest on this loan? So he started out lending some of these gold coins & then later he realizes, actually people don't even want the gold coins. They just want the piece of paper that says - the gold coins are in the bank & with the goldsmith. So the goldsmiths could now make a loan with these pieces of paper. & whatever the goldsmiths wrote on a piece of paper, as long as people trusted them, they'll trust the paper. & effectively the goldsmiths & the early day bankers had literally acquired the power to print money.

More & more private paper money from merchants & banks circulated & began to rival the crown's coins. The power inherent in controlling & issuing money, began slipping away from the rulers. They couldn't tax or debase this new kind of money.

But they had bigger ambitions than ever with trading posts, colonies, & empires that now stretched across the globe. For centuries European countries would take turns building massive fleets & waging war on each other to rule the world. Government wanted to take the people's money in order to finance its wars. That's essentially the history of money. Money & warfare go together. War is expensive, one year's income taxes simply aren't enough. Kings & queens had to borrow money against future taxes. They needed a groundbreaking financial innovation. Government bonds! The loans came from rich merchant families & goldsmiths, who by now had become powerful financiers & bankers. Sovereign debt & deficit spending had been born.

In 1694, The Bank of England was established to fund a war against France. England central bank was privately owned & granted the monopoly to issue banknotes. Paper that could be redeemed for an equal amount of gold from the government coffers. The central bank soon also managed the entire debt of the crown. Money has been a tool of sovereignty for centuries. Being able to issue currency, gave you the power but it also gave the value to that monetary supply, by backing it with a force of state. With essentially the debt of the state.

When the US won independence from Britain, the first article of the new constitution gave Congress the exclusive right to coin money. This currencies value was tied to gold in government vaults. From 1781 until the panic of 1907, the financial system of the US was an economic petri dish; brief central banks, state banks, private banks, private currency, government currency, depressions, strong growth, recessions, regular boom & bust cycles.

In 1913, bankers & politicians decided that it was in the country's best interest & theirs, to have a permanent central bank. They created the Federal Reserve. Among it's jobs: expand or contract the supply of a single national currency - the Federal Reserve Note. The dollar was tied to gold & strategic control of it would avoid booms that lead to busts. At least that was the plan. Then came 1929. The Great Depression would have a profound effect on monetary policy worldwide.

Soon the Fed had printed nearly all the money it legally could to pump life back into the economy. It needed gold to fire up the mint. So in 1933 President Roosevelt issued a controversial executive order, forcing all US citizens to sell their gold to the Federal Reserve at a fixed price or go to prison. The Fed offered far more cash to foreign governments for their gold. Many jumped at the offer, gold flowed in & dollars spread across the globe.

World War 2 devastated nearly every major economy, except the United States. The military & industrial juggernaut emerged as THE global financial superpower. The Dollar had become the world's most stable & trusted currency. Other countries pegged their currency to the dollar, which could still be redeemed for gold. In fact the US owned more than half of the world's gold reserves. In the next few decades more dollars flowed to foreign countries, governments began debasing their coins with cheaper metals & printing more of their own currency than they had in gold. The bond between precious metals & paper currency was cracking.

By 1966 foreign nations had had enough of the US collecting gold & printing cash. & they had more value in dollars than the US had gold bullion in its vaults. They demanded gold in return for their paper dollars. Arguments about the value of the dollar versus their currency ensued.

In 1971 President Nixon settled the matter - “temporarily”. He severed United States currency from the gold standard. Never again could anyone legally demand US government gold in exchange for paper dollars.

For better or worse, the dollar was now backed solely by the full faith & credit of the United States government. The wealthiest nation the world had ever known, would bet its future on a single word:

“Trust”.

People have this mythology of money that is based on very little fact, & one of the nice things about Bitcoin is that it forces people to start to ask questions about the fundamentals of money.

Bitcoin is an attempt to adopt the advanced computerized system that we have, the internet, to resurrecting what money used to be all about.